Best CPA Networks for High-Approval Loan Offers (Leadgid vs Others)

The best CPA networks for loan offers are the ones that match your GEO lender density, allowed traffic, payout cadence, reporting/API, and manager support. To make the best choice, shortlist a few options, run one clean cohort test per network for 7–14 days, and pick the partner that delivers stable approvals with the least friction.

Key takeaways

- Approval fit beats brand name. Choose by GEO coverage + lender density + allowed traffic (offer-level), not by logo.

- Tier-2 first. If you’re new, look for loan CPA networks for Tier 2 countries to learn faster and cheaper.

- Prefer loan CPA offers with weekly payouts (where eligible) to tighten your test–learn loop.

- Tools matter: reporting/API, postbacks, cohort views and responsive AMs save weeks.

- Policy is offer-specific. Confirm SEO/email/social and brand bidding in writing; add a compliant pre-lander (eligibility + fees/timelines).

- Keep a weekly loop: approvals feedback → copy/UX edits → re-measure EPC (see Benchmarks page).

Best CPA Networks for Loan Offers

Finding the right affiliate network can make or break your loan campaigns, which is why understanding the basics of what makes a network truly “best” is critical. In this context, “best” means the network most likely to deliver consistent approvals and steady Earnings Per Click (EPC) — a key metric calculated as total revenue divided by total clicks — for your specific traffic. Choosing wisely requires evaluating networks across multiple dimensions, from geographic coverage to reporting capabilities, so you can confidently scale offers without losing money to poor targeting or slow payouts.

How We Evaluate “Best” (Method & Criteria)

To ensure every recommendation is actionable, we apply these criteria consistently:

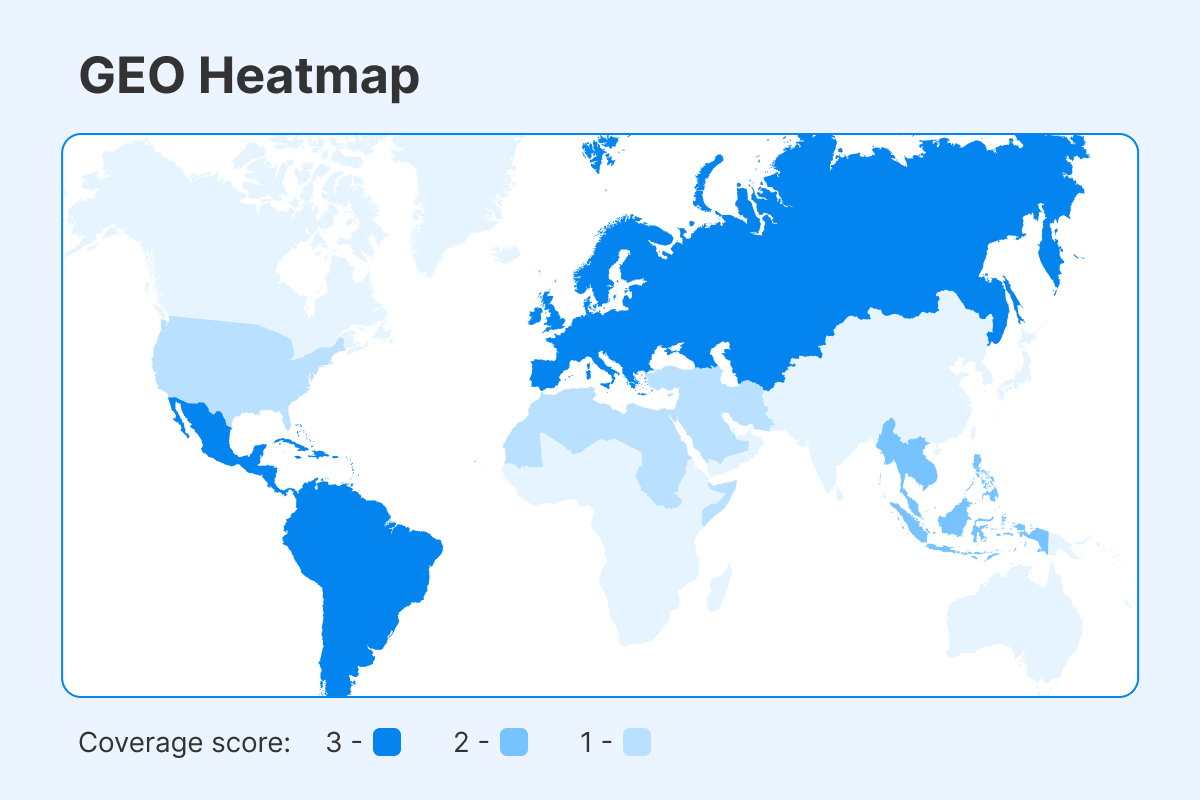

- GEO coverage & lender density. Are there enough lenders in your target countries to maintain approval flow?

- Loan types. Assess which verticals — payday/micro, installment/personal, or cards/credit repair — match your traffic profile.

- Allowed traffic. Confirm offer-level permissions for SEO, email, social, and brand bidding to avoid compliance issues.

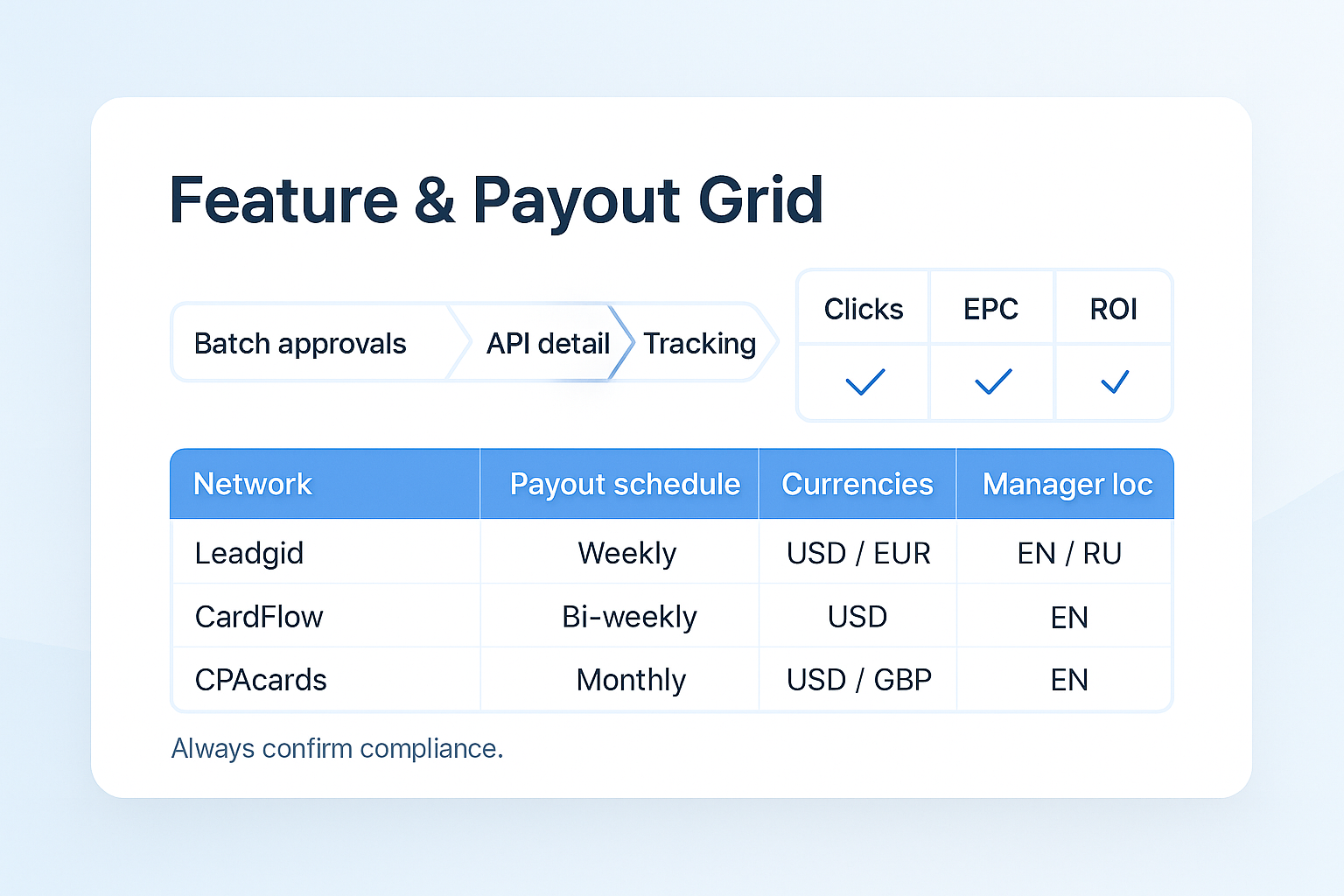

- Payout cadence & currencies. Check weekly or NET payouts, and whether multiple currencies are supported.

- Reporting/API & postbacks. Look for clean cohort reporting and server-to-server (S2S) postbacks that make reconciliation simple.

- Manager support & localization. Fast, knowledgeable account management and proper language alignment improve approvals and troubleshooting speed.

- Onboarding/KYC speed. How quickly can you get started testing offers without unnecessary delays?

Ultimately, approvals and EPC are driven by a combination of policy fit, pre-qualification, and mobile UX. If approvals are tight, optimize those areas first — then scale confidently for maximum ROI.

Compare high-approval loan CPA networks — Start on Leadgid.

Shortlist — Who’s on the Radar

If you’re wondering which CPA networks offer payday loans, it’s important to focus on platforms that combine strong lender access, multi-region support, and approval-friendly workflows. The networks below are currently on our radar for affiliates seeking stable EPC and reliable approvals across a variety of loan types, from microloans and installments to payday and personal credit offers. Each comes with unique strengths, so matching the network to your GEO, traffic type, and campaign goals is key.

- Leadgid. Multi-GEO finance focus; approval-oriented workflows; helpful when you need hands-on manager feedback and cohort-friendly reporting. Use when: testing ES/MX/PH/IN/KZ or mixing microloan + installment flows.

- financeAds (EU). Europe-centric finance marketplace with bank/fintech programs. Use when: operating in EU markets and needing regional coverage and local AMs.

- Round Sky (US). US short-term loan specialists with fast decisioning lenders. Use when: you have US intent and want depth in payday/personal leads.

- LeadsMarket (US). US marketplace model connecting to multiple lenders. Use when: you need lender density and marketplace routing in the US.

- Leadtree Global (UK/US). Short-term loan broker model across UK/US. Use when: you work with pingtree/broker flows and need both regions.

- Involve Asia (SEA). Southeast Asia aggregator with app-driven finance programs. Use when: targeting PH/ID/MY/TH with social/UGC (if allowed per offer).

- vCommission (IN-first). India-focused partner network with finance verticals. Use when: building IN cohorts and needing local programs/support.

- Admitad / Awin (Aggregators). Broad multi-GEO access to finance advertisers. Use when: you want to source local loan/card programs across several markets.

- CityAds (KZ/CIS). Coverage across KZ/CIS with finance verticals. Use when: you operate in RU/KZ languages and need regional lenders.

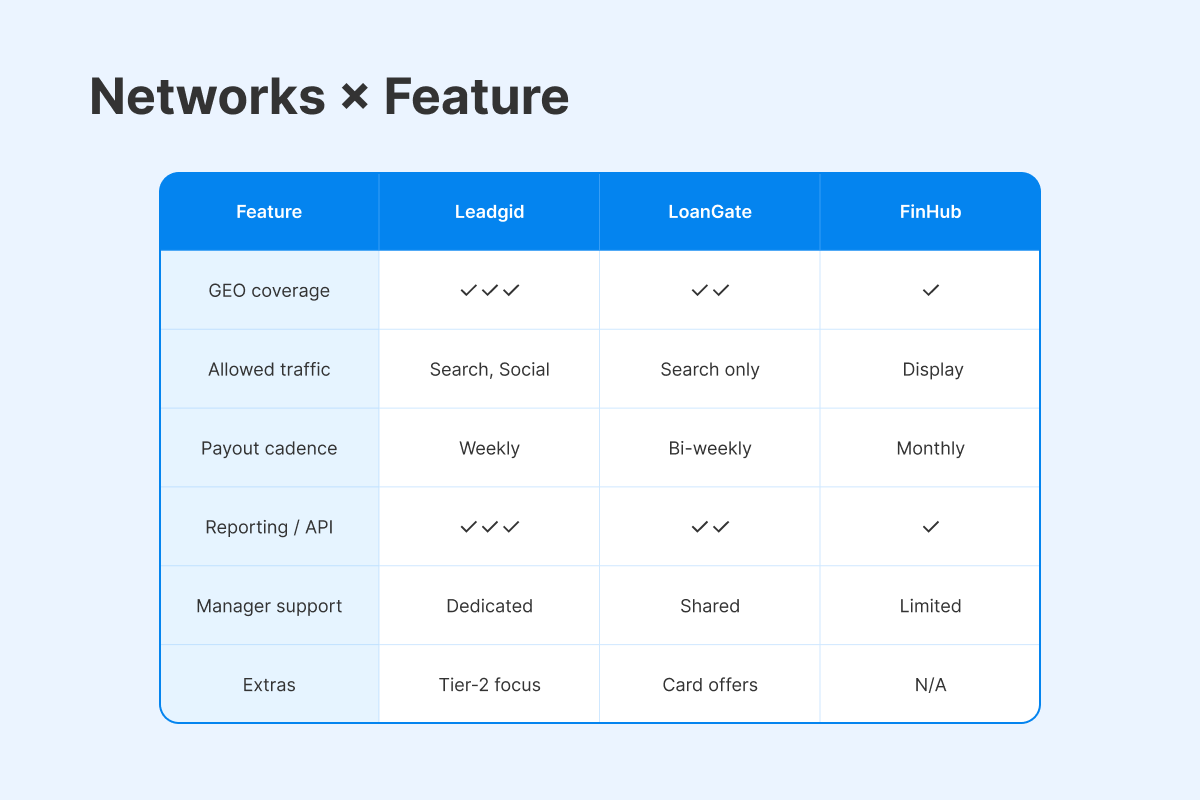

Loan CPA Networks Comparison — at a glance

Policies vary by offer. Always confirm SEO/email/social and brand bidding in writing and build a compliant pre-lander (“subject to lender approval,” fees/timelines, T&Cs).

|

Network |

GEO coverage (examples) |

Loan types |

Allowed traffic* |

Payout cadence |

Currencies |

Reporting / API |

Manager support |

Use when |

|

Leadgid |

ES, MX, PH, IN, KZ + others |

Micro/payday, installment, personal, cards |

Per-offer; pre-lander recommended |

Weekly / NET (per offer) |

Multi-currency |

Dashboard, postbacks, API |

Local/regional AMs |

Multi-GEO tests; need fast approvals feedback |

|

financeAds (EU) |

ES, DE, PL, etc. |

Micro, installment, cards/fintech |

Per-offer |

Per program |

EUR + local |

Network reporting |

Local AMs |

EU coverage with bank/fintech |

|

Round Sky |

US |

Payday, personal |

Per-offer |

Per program |

USD |

Real-time reporting |

AM support |

US short-term depth |

|

LeadsMarket |

US |

Payday, personal |

Per-offer |

Per program |

USD |

Marketplace dashboard |

AM support |

US lender marketplace density |

|

Leadtree Global |

UK, US |

Short-term/broker |

Per-offer |

Per program |

GBP/USD |

Network reporting |

AM support |

UK/US broker/pingtree |

|

Involve Asia |

PH, ID, MY, TH, SG |

Loan apps, finance offers |

Per-offer |

Per program |

Local/APAC |

Dashboard |

Regional AMs |

SEA app-driven finance |

|

vCommission |

IN (+ SG/UAE/UK/US) |

Loans, cards |

Per-offer |

NET terms |

INR + |

Network reporting |

AM support |

India-first + regional |

|

Admitad / Awin |

Multi-GEO |

Loans/cards/fintech |

Per-offer |

Per program |

Multi-currency |

Network tools/API (varies) |

AM support |

Sourcing local programs |

|

CityAds |

KZ/CIS + |

Micro/short-term |

Per-offer |

Per program |

KZT/RUB + |

Network tools |

AM support |

KZ/CIS coverage |

* “Per-offer” means: check the specific program’s policy for SEO/email/social, brand terms, and pre-lander requirements.

Feature matrix visual (icons for payout cadence, API, manager support).

Leadgid vs Others — high-approval use cases

- Choose Leadgid when… you need multi-GEO coverage and manager feedback to iterate on approvals quickly (eligibility copy, localization, routing). Good for blending micro + installment/personal and for approval-focused reporting.

- Choose a US-centric specialist when… your intent is purely US payday/personal and you want depth with fast-decision lenders (e.g., Round Sky, LeadsMarket).

- Choose an EU microloan marketplace when… you operate in ES/PL/DE and want regional bank/fintech programs (e.g., financeAds).

- Choose SEA/IN partners when… you target PH/ID/MY/TH/IN and need local app-driven or bank programs with regional AMs (e.g., Involve Asia, vCommission).

- Choose CIS-focused options when… you’re running KZ/CIS flows and need RU/KZ language plus local lender coverage (e.g., CityAds).

If short-term approvals stay tight, pivot to the best affiliate programs for personal loans or installment products (often broader eligibility). If card approvals underperform, route to credit repair where compliant.

Comparator diagram (Leadgid vs categories of alternatives with “use-when” arrows).

Picking your starter network (Tier-2 first)

Use this 5-point checklist for choosing the best loan CPA networks for Tier-2 countries:

- GEO lender density in ES/MX/PH/IN/KZ (or your target Tier-2).

- Allowed traffic matches your real channel (get it in writing).

- Payout cadence supports learning (weekly/NET per offer).

- Manager response time (approval reasons weekly).

- Reporting/API with postbacks & cohort columns out of the box.

Need help picking a GEO/network? Talk to a manager.

Benchmarks & Setup (What to Expect)

Before scaling any campaign, it’s crucial to know what “normal” looks like. Establishing benchmarks and a clean setup helps you track Earnings Per Click (EPC), approvals, and funnel health accurately, making it easier to spot issues, optimize quickly, and avoid unnecessary troubleshooting.

- Establish a Week-1 baseline for EPC and approvals (see Benchmarks page).

- Structure cohorts by GEO / device / source / angle; run one clean test per network for 7–14 days.

- Add postbacks + UTMs and pin a cohort view with EPC + Approval.

- If you ask “why did my EPC drop on loan offers,” check approvals first, then lender mix, device friction, and policy fit.

Mini “How-to” — first 5 steps

Starting a new campaign is easiest when you follow a clear, repeatable process. These first five steps guide you from network selection to cohort setup, ensuring clean tracking, policy compliance, and reliable Earnings Per Click (EPC) and approval data for ongoing optimization.

- Shortlist two networks that cover your GEO + allowed channel.

- Confirm offer-level policy (SEO/email/social/brand terms) and disclosures.

- Build a pre-lander with eligibility + fees/timelines + “subject to lender approval.”

- Launch one cohort per network; pin EPC + Approval; no mixing variables.

- Weekly: log approval reasons → update eligibility copy/UX → re-measure.

Cohort flow (choose network → set allowed traffic → pre-lander → approvals/EPC).

Common Mistakes (and Quick Fixes)

Before diving into scaling, it’s helpful to recognize the most frequent pitfalls affiliates face and how to address them quickly. Avoiding these errors preserves approvals, stabilizes EPC, and keeps your tracking and reporting reliable, so you can focus on growth rather than constant troubleshooting.

- Choosing by logo, not fit. → Filter by GEO, lender density, and allowed traffic.

- No pre-lander. → Denials spike; add eligibility, fees, and timelines above the fold.

- Brand bidding without approval. → Usually disallowed; remove unless explicitly permitted.

- Mixing GEOs/sources/angles. → Keep cohorts clean for 7–14 days.

- Ignoring payout ops. → Confirm cadence, currencies, and cut-off before scaling.

By combining disciplined cohort setup, approval-focused optimizations, clean tracking, and awareness of common mistakes, your campaigns are positioned for predictable growth and steady EPC. Pairing these practices with the right CPA networks ensures you maximize approvals while minimizing wasted clicks.

Ready to test? We’ll verify allowed traffic, review your pre-lander, and pin the right cohort report. Join!

FAQ

- The “best” depends on GEO fit, allowed traffic, payout cadence, reporting/API, and manager support. Use the comparison table and run one clean cohort per candidate.

- Strong lender density in your GEO, clear eligibility wording on a pre-lander, compliant flows, and rapid AM feedback on denial reasons.

- GEO coverage & lender density, offer-level allowed traffic, payout cadence/currencies, reporting/API & postbacks, manager support/localization.

- Several list payday/micro loan programs, but approval rules and sources are offer-specific; pre-landers are often required and brand bidding is typically disallowed.

- When short-term approvals are tight or user profiles are broader; installment/personal loans can stabilize approvals in some GEOs.

- Strengths: multi-GEO coverage, approval-focused workflows, cohort-friendly reporting, responsive AMs. Limitations vary by specific offers; confirm allowed traffic and payout cadence case-by-case.