If you’ve ever asked what is epc in loan affiliate marketing, it’s earnings per click: total revenue divided by total clicks for the same cohort and time window. EPC moves mostly with approval rate, lender mix, and device friction. Set a week-1 baseline, then raise EPC by improving pre-qualification, compliant copy, and mobile UX, one lever per week.

Key takeaways

- EPC = earnings ÷ clicks; it’s only meaningful when you measure by consistent cohorts (GEO / device / source / angle).

- Approvals drive EPC more than CTR. Fix eligibility clarity, fees/timelines copy, and mobile forms before chasing traffic volume.

- Treat “benchmarks” as orientation, not promises; expect variation by GEO and channel.

- Keep an evidence trail: allowed-traffic screenshots, wording approvals, denial reasons, change log.

- Run 7–14 day clean tests; change one thing at a time; compare week over week.

Definition & formula (copy-bank ready)

If you’re asking “what is EPC in loan affiliate marketing,” it’s a key performance metric that measures the revenue generated per click for a specific cohort over a defined time period. Understanding EPC — Earnings Per Click — is fundamental for affiliates because it allows you to compare traffic sources, GEOs, devices, and angles on a standardized basis, helping you identify which campaigns are truly profitable versus those that just drive clicks without approvals.

Formula:

EPC=Total ClicksTotal Revenue(for the same cohort and dates)

[ \text{EPC} = \frac{\text{Total Revenue}}{\text{Total Clicks}} \quad (\text{for the same cohort and dates}) ]

[pic] Formula card (EPC = revenue ÷ clicks + tiny example).

EPC formula example:

|

Cohort (GEO • Source • Device • Angle) |

Clicks |

Revenue |

EPC |

|

ES • SEO • Mobile • “Eligibility-A” |

1,000 |

$410 |

$0.41 |

|

MX • Social • Mobile • “Fees-Explainer” |

800 |

$248 |

$0.31 |

|

PH • SEO • Desktop • “Timeline-Plain” |

600 |

$162 |

$0.27 |

Key Takeaway: Read EPC carefully. If you notice a dip in EPC, do not immediately scale traffic. Instead, first diagnose underlying issues such as approval rates, lender fit, or funnel friction, then iterate on pre-lander copy, UX, or offer targeting. EPC is not just a click metric — it reflects the efficiency of your full conversion flow and is a reliable indicator of which cohorts are truly profitable.

Understand & improve EPC — Start on Leadgid.

EPC vs CR (and EPL/EPV): What each tells you

When analyzing loan affiliate campaigns, it’s important to understand the differences between Earnings Per Click (EPC), Conversion Rate (CR), and related metrics like Earnings Per Lead (EPL) or Earnings Per Visit (EPV). Each provides a unique perspective on performance, helping you pinpoint opportunities for optimization across the funnel.

- CR (Conversion Rate) zooms in on a specific step of the funnel, such as submit → approve, allowing you to identify friction points or bottlenecks that block approvals.

- EPC combines payout × approvals into a single economic signal, reflecting overall campaign profitability across cohorts, sources, and angles.

- EPL (Earnings Per Lead) is valuable for lead-centric funnels, where the focus is on maximizing revenue per submitted lead rather than per click.

- EPV (Earnings Per Visit) is useful for page-level UX analysis, showing how effectively a landing page converts general traffic into monetizable actions.

Use EPC to monitor top-line campaign health, while CR and approval metrics help you identify which step of the funnel to optimize and where to apply your next lever for growth.

Benchmarks & reading EPC (2025 orientation)

When evaluating loan affiliate campaigns, it’s crucial to treat benchmarks as calibration points rather than promises. Your performance will vary depending on GEO, lender density, traffic quality, and channel fit, so use these ranges as a guide to identify areas for optimization rather than strict targets. Understanding each metric in context helps you interpret Earnings Per Click (EPC) trends accurately and take meaningful action to improve approvals and revenue.

- CTR (intent pages): ~2–6%, reflecting the proportion of users who engage with your pre-lander or intent content.

- Pre-lander CR: ~10–25%, with the lower end lifted by clear eligibility bullets and transparent fees.

- Submit rate: ~30–60%, affected by form friction, device usability, and user confidence.

- Approval rate: Varies by product and GEO; installment/personal loans typically show steadier approvals than short-term offers.

- EPC: Set a week-1 baseline and focus on steady week-over-week lift rather than chasing spikes, using it as your top-line indicator of campaign health.

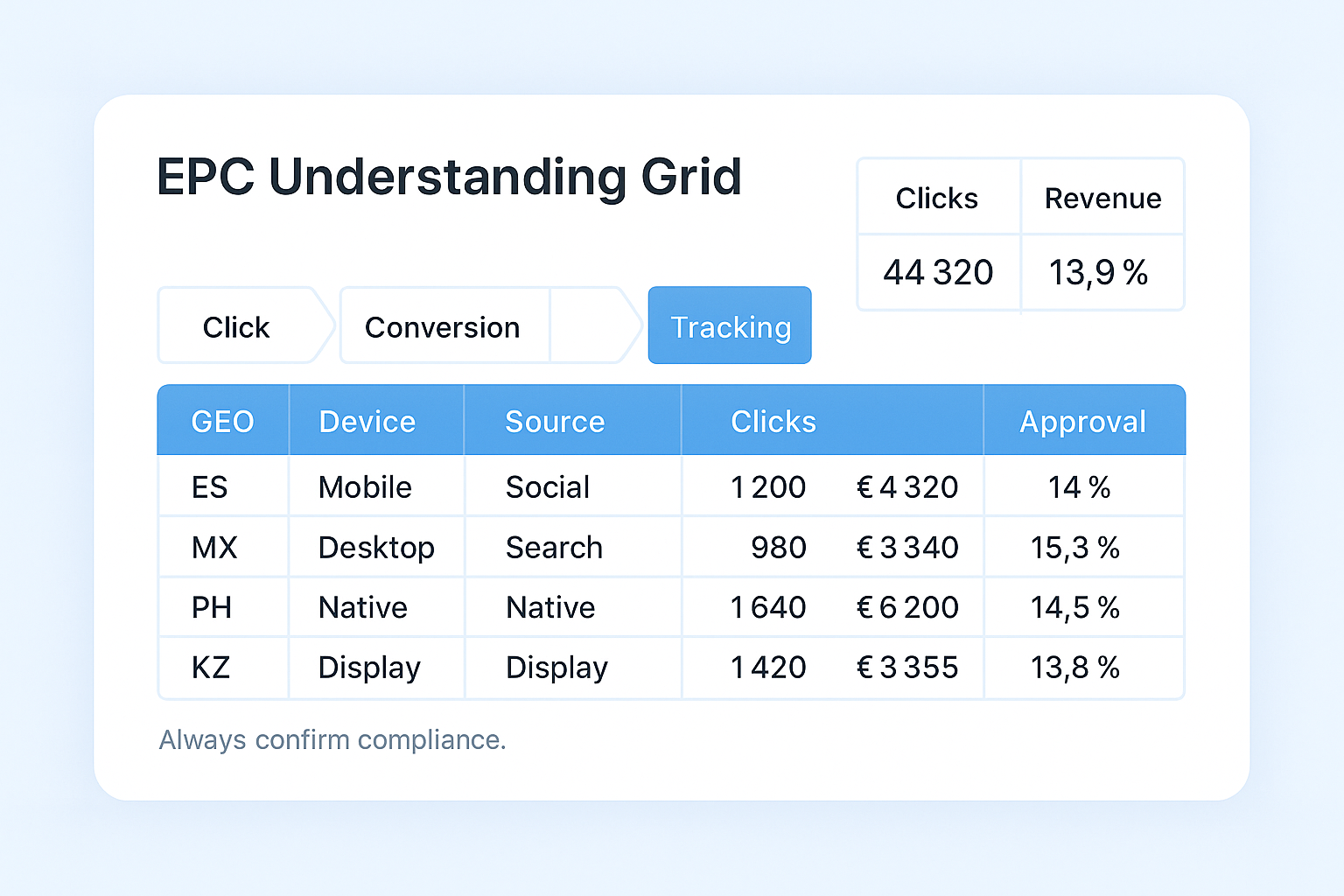

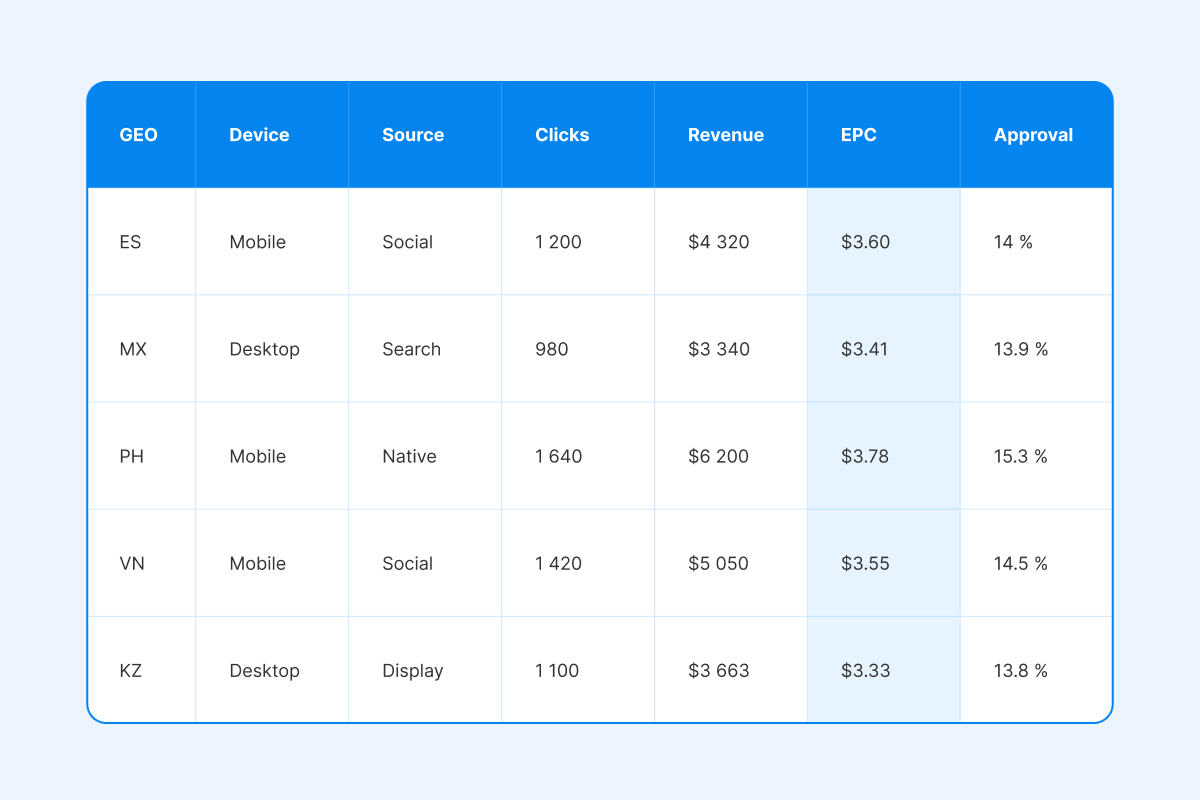

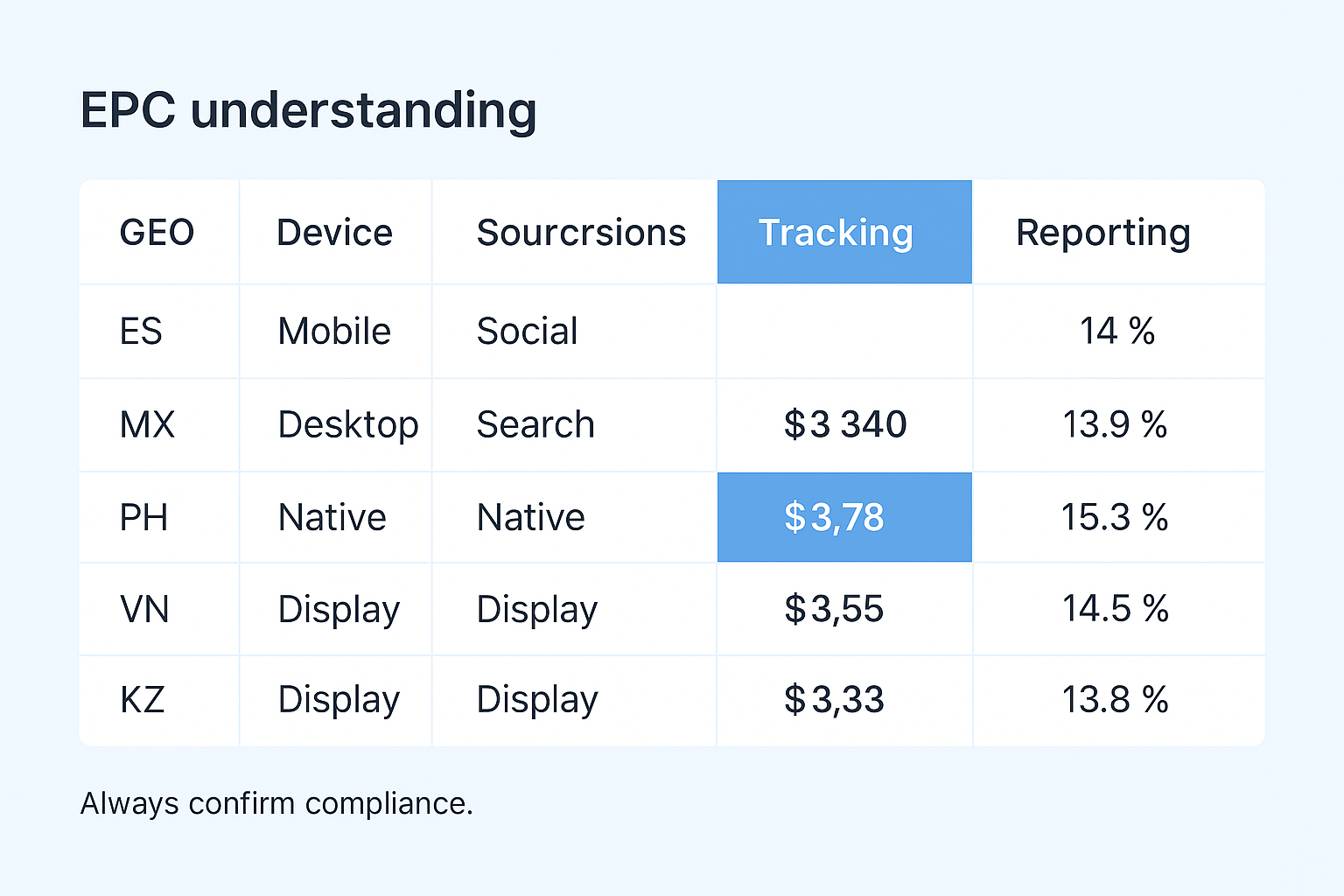

Cohorts & instrumentation

Accurate tracking and structured cohort management are essential for understanding which segments of your traffic drive approvals and Earnings Per Click (EPC). Proper instrumentation allows you to isolate variables, evaluate performance, and make data-driven optimizations without conflating results from different sources or angles.

- Tag every click with UTMs and a unique click ID; enable server-to-server (S2S) postbacks so that approvals and payouts can be attributed to the correct cohort.

- Cohort fields: GEO / device / source / angle. Keep each cohort clean and stable for 7–14 days to gather reliable performance data.

- Pin a saved view with EPC + Approval columns, and annotate any copy or UX changes to track the impact of optimizations over time.

Need help reading cohorts? Talk to a manager.

[pic] Cohort dashboard mock (GEO/device/source/angle, EPC + Approval columns).

Why EPC moves (diagnostics)

Understanding why Earnings Per Click (EPC) fluctuates is key to optimizing loan affiliate campaigns. EPC reflects not just traffic volume but the efficiency of your entire funnel, so diagnosing changes requires looking at approvals, lender behavior, device performance, policy compliance, and seasonal trends.

- Approval rate change: Re-read denial codes, tighten eligibility wording, and verify policy fit to ensure approvals are not artificially suppressed.

- Lender mix shift: If a top-paying lender paused, rotate in alternatives and monitor how approval patterns respond.

- Device friction: Address slow-loading pages, bad input masks, and tiny tap targets, prioritizing mid-range Android devices where most friction occurs

- Policy drift: Watch for disallowed channels or creeping claims; revert copy and re-confirm permissions in writing to maintain compliance.

- Seasonality: Consider payday cycles, holidays, and salary calendars; compare performance to the previous cycle rather than just last week to understand context-driven fluctuations.

Playbooks — practical ways to raise EPC

Boosting Earnings Per Click (EPC) requires targeted, approval-focused optimizations rather than simply increasing traffic. These practical playbooks focus on clarifying eligibility, reducing friction, localizing content, and managing user intent, ensuring each click has the highest potential to convert and remain compliant.

- Pre-qualify above the fold: Include age, residency, and income bullets, along with the disclaimer “subject to lender approval.”

- Make costs and timelines scannable: Show repayment cadence, fees, and examples in plain language to reduce confusion and denials.

- Fix mobile forms: Compress assets, provide visible error hints, correct keyboard types, and widen tap targets to improve form completion.

- Localize currency and pay cycles: Tailor content to the GEO and avoid promise-driven language.

- Route mis-fit users: Redirect users unlikely to qualify to credit repair, secured card, or credit-builder flows instead of wasting intent.

- Manager loop: Log approval reasons weekly and reflect insights in copy, routing, and funnel adjustments to continuously improve EPC.

EPC troubleshooting checklist (symptom → fix)

Even well-structured loan affiliate campaigns encounter performance hiccups, so having a clear troubleshooting framework helps you quickly identify issues and take targeted action. By mapping symptoms to likely causes, initial fixes, and key metrics to measure, you can maintain clean cohorts, protect approvals, and stabilize Earnings Per Click (EPC).

|

Symptom |

Likely cause |

First fix |

Measure next |

|

EPC down, clicks flat |

Approvals slipped |

Add/clarify eligibility bullets; confirm policy fit |

Approval rate, denial codes |

|

High clicks, low submit |

Form friction |

Simplify fields; fix errors; mobile QA |

Submit rate, device breakdown |

|

Stable approvals, EPC down |

Lender mix changed |

Swap/rotate lenders; monitor cohorts |

EPC trend per lender |

|

Volatile EPC by device |

Performance issues |

Compress assets; optimize mobile |

LCP, form error rate |

|

Spike in complaints |

Copy drift |

Remove promise terms; add disclosures |

Complaint rate, approvals |

|

Net revenue < gross |

Clawbacks |

Track net EPC; investigate causes |

Clawback rate by cohort |

[pic] Root-cause tree (EPC drop → approvals/lender mix/friction/policy/seasonality).

Mini “How-to” — improve EPC in 5 steps

Optimizing Earnings Per Click (EPC) requires a structured, iterative approach rather than random tweaks. By systematically reviewing cohorts, identifying bottlenecks, and applying targeted improvements, you can increase approvals and revenue while maintaining clean data and compliant flows.

- Snapshot last 7–14 days by cohort; record EPC + Approval.

- Pick one bottleneck (often approvals).

- Apply one playbook (eligibility copy, mobile fix, lender rotation).

- Hold steady 7–14 days; no stacking changes.

- Retro: log outcomes, save evidence, choose next lever.

Common mistakes (and quick fixes)

Even experienced affiliates can stumble on small but critical errors that reduce approvals and Earnings Per Click (EPC). Understanding the most frequent mistakes—and knowing how to correct them—keeps campaigns compliant, efficient, and data-driven.

- Chasing traffic volume before approvals → Focus first on pre-qualifying users and clarifying costs/fees.

- Mixing GEO/source/angle in one test → Split cohorts and maintain clean 7–14 day test windows.

- Promise language (“instant/guaranteed”) → Replace with eligibility-focused phrasing and include all T&Cs/disclosures.

- No postbacks → Ensure tracking and S2S postbacks are working correctly before scaling budgets.

Maintaining strong performance in loan and credit affiliate campaigns comes down to discipline, cohort cleanliness, and compliance. By avoiding common pitfalls, tracking the right metrics, and iterating methodically, you can protect approvals and steadily improve EPC across all campaigns.

Weekly wins = clean cohorts. We’ll help you pick the next lever. Join Leadgid today!

FAQ

- Divide earnings by clicks for one cohort/time window. Example: $410 ÷ 1,000 clicks = $0.41.

- Use EPC for top-line economics; use CR and Approval rate to diagnose the lever that will move EPC.

- Use orientation ranges only; your EPC depends on GEO, lender density, channel fit, and device friction. Establish a week-1 baseline and trend up.

- Check approvals first, then lender mix, mobile friction, policy drift, and seasonality. Compare to prior cycles.

- The first three steps are: Add eligibility bullets above the fold, make fees/timelines plain, and fix mobile form friction.

- EPC = per click; EPL = per lead; EPV = per visit. EPC for top-line, EPL for lead funnels, EPV for page UX.

- Group by GEO/device/source/angle, pass UTMs + click ID, enable S2S postbacks, pin EPC + Approval, and compare week over week.

- Keep tests clean 7–14 days, one change at a time, and annotate every change. Reconcile currencies when analyzing.

- Yes, they can. Track net revenue (after clawbacks) and monitor patterns by GEO, lender, and traffic source.