Loan CPA offers that allow social traffic exist, but permissions are offer-level and differ by platform. Get written approval for each channel, route all clicks through a compliant pre-lander (eligibility, fees/timelines, disclosures), and track clean cohorts (GEO/device/source/angle) so you can raise Approvals → EPC with week-over-week iteration.

Key takeaways

- Social is policy-first: platform rules + offer-level permissions (SEO/email/social/brand terms) govern everything.

- A pre-lander is non-negotiable in finance: state eligibility, fees, timelines, and “subject to lender approval.”

- Go native-first per platform (threads, shorts, carousels, explainers) and disclose relationships clearly.

- Instrument every link with UTMs + click ID; keep one clean cohort per 7–14 days.

- Optimize for approval fit, not vanity traffic: copy clarity + mobile UX beats volume.

- Keep an evidence trail: screenshots of permissions, wording approvals, moderator messages, and enforcement outcomes.

Policy & scope: social media compliance for finance affiliates

When promoting loan CPA offers that allow social traffic, understanding the rules and scope of compliance is the foundation of any successful campaign. Social platforms like Reddit, YouTube, Facebook, and LinkedIn have their own advertising policies, while lenders require specific offer-level permissions, so navigating this space safely demands a structured approach. Before posting, you need to align three key areas: (1) offer-level permissions, including which channels are allowed, brand terms, and required disclosures; (2) platform-specific rules for both organic and paid content; and (3) your internal legal or compliance review to ensure no regulatory or network violations occur.

Always disclose your affiliate relationship wherever your content appears, and avoid promise-driven language such as “instant” or “guaranteed.” Instead, use compliant phrasing like “check eligibility” or “subject to lender approval.” Never bypass a required pre-lander by deep-linking directly to a lender, as this can trigger denials or non-compliance flags. Finally, maintain a thorough evidence log by archiving all approvals, screenshots, and policy confirmations. This ensures you have a reliable record to defend campaigns and maintain high approval rates while scaling social traffic effectively.

Run compliant social flows — Start on Leadgid.

Platform playbooks (formats, hooks, compliance)

Reddit — community-first credibility

Use this only where subreddit rules allow promotions and educational resources, and always respect reddit affiliate marketing finance rules.

How to do it well (aka how to promote loan offers on reddit):

- Post problem/solution threads, checklists, or AMA-style Q&As. Lead with education: “who qualifies / who should not apply,” fees, timelines.

- Provide tools (eligibility checklists, repayment calendars) and case study style summaries (no promises).

- Link once, near the end, to your pre-lander; add a plain disclosure line.

- DM moderators if needed; store ModMail approvals.

- Don’ts: referral spam, brand bidding, rate promises, or evasive language.

Hook bank (swap per GEO):

- “Fees & timelines explained in plain language”

- “Short-term vs. installment: when each makes sense”

- “Top 5 reasons applications get declined (and what to do first)”

YouTube — search + trust at scale

Plan content around keywords users already search and deliver value in 5–7 minute chunks. Include on-screen and spoken disclosures and follow youtube disclosure requirements for affiliates. Use this section to ideate youtube content ideas for finance affiliates:

Formats that work:

- Explainer: “How loan timelines & fees work” with a whiteboard walkthrough.

- Comparison: “Short-term vs installment loans — fit & trade-offs.”

- Eligibility walkthrough: “5 checks before you apply (by GEO).”

- FAQ shorts: 45–60 sec answers with a “learn more” CTA.

Structure (long video):

- 0:00–0:20 Hook (problem stated, no promises)

- 0:20–2:30 Core concept (eligibility, costs, timelines)

- 2:30–4:30 Examples + what to avoid

- 4:30–6:00 How to check eligibility (route to pre-lander)

- Outro with disclosure reminder

Linking: Description + pinned comment → pre-lander with UTMs + click ID; end-screen CTA to the same page.

Facebook — short, visual, compliant

Know the Facebook policy for loan affiliate marketing and keep posts simple and scannable.

Post blueprint (organic or boosted where allowed):

- Creative: static image or 10–20s short with large captions.

- Copy (3 bullets): eligibility, costs/timelines, how decisions are made.

- CTA: “Check eligibility” → pre-lander.

- Notes: avoid prohibited financial claims; keep Page Quality screenshots and policy confirmations on file.

LinkedIn — professional tone, high intent

Adopt a linkedin content framework for finance affiliates that mixes credibility with clarity.

Working formats:

- Carousel: “Eligibility checklist by GEO” (5–8 slides; each ends with “Check eligibility”).

- Case study post: week-over-week approval uplift after clarifying fees and device UX (no figures that imply guarantees).

- Article: “Fees & timelines — a plain-language guide for borrowers.”

CTA: “See the eligibility checklist” → pre-lander. Use native document posts for extra reach.

[pic] Platform grid (Reddit/YouTube/Facebook/LinkedIn + allowed formats).

Social → Landing flow

Treat your pre-lander as a compliance and UX buffer. Build and style it once, then localize.

Your social pre-lander template for loan offers should include:

- Eligibility bullets (age/residency/income/account).

- Costs & repayment timelines in plain language; example schedule.

- How it works (3 steps): check → submit → lender decision.

- Disclosures & links: T&Cs, privacy/consent, “subject to lender approval.”

- CTA: “Check eligibility” (never “Instant approval”).

- Mobile UX: fast LCP, clear errors, right keyboard on inputs, large tap targets.

- Localization: currency symbols, pay cycles, service hours.

Need post formats or disclosures? Talk to a manager.

[pic] Social→Pre-lander flow (with required blocks).

Tracking & cohorts

Tag everything and keep tests clean.

Playbook for tracking UTMs for social cohorts:

- utm_source: reddit / youtube / facebook / linkedin

- utm_medium: organic / paid

- utm_campaign: GEO code (e.g., ES, MX, PH, IN, KZ)

- utm_content: angle (fees-explainer, eligibility-A, timelines-B)

- click ID: unique value used in postbacks to stitch approvals/payouts

Pin a dashboard view per cohort with EPC + Approval columns; hold the test steady for 7–14 days, then iterate one lever.

[pic] Cohort tagging diagram (UTMs + click ID).

How to drive approvals from social traffic

Turning clicks from Reddit, YouTube, Facebook, and LinkedIn into actual approvals requires more than just high engagement—it demands approval-focused optimization across content, pre-landers, and user flows. Social traffic can be unpredictable, so following a structured approach ensures that the right users are guided efficiently through your funnel while staying compliant.

- Pre-qualify in the content: Clearly explain who fits the offer and who doesn’t, including any trade-offs, so users self-select before clicking.

- Mirror copy on the pre-lander: Use the same eligibility bullets and costs/timelines above the fold to reinforce transparency and reduce denials.

- Strip promise language: Avoid terms like “instant” or “guaranteed”; keep messaging compliant with “subject to lender approval.”

- Mobile-first UX: Reduce form fields, provide clear error hints, and compress assets for faster load times and smoother completion.

- Route mis-fit users: Redirect users unlikely to qualify to credit repair, secured cards, or credit-builder flows to preserve intent and monetization (see Page #11).

- Weekly approvals loop: Review denial reasons, adjust eligibility or cost copy, and retest to continuously optimize EPC and approval rates.

Troubleshooting matrix (symptom → fix)

Even the best social campaigns for loan CPA offers can hit performance bumps, so having a structured troubleshooting matrix helps you quickly diagnose issues and take precise action. By linking symptoms to likely causes and quick fixes, you can maintain clean cohorts, protect approvals, and stabilize Earnings Per Click (EPC) across multiple social platforms.

|

Symptom |

Likely cause |

Quick fix |

|

Low clicks from posts |

Hooks too abstract; no value |

Use “fees/timelines/eligibility” hooks; add micro-FAQ snippet |

|

Clicks ↑, pre-lander CR ↓ |

Copy mismatch / heavy page |

Mirror social copy; move bullets above the fold; compress assets |

|

CR OK, approvals ↓ |

Policy/fit issue |

Re-write eligibility; reconfirm channel permission in writing; try adjacent product |

|

Volatile EPC by platform |

Mixed cohorts or outages |

Split cohorts per platform/angle; pause and relaunch clean |

|

Complaints/mod removals |

Disclosure/culture mismatch |

Add crystal-clear disclosures; adjust tone per community; store mod approvals |

Need platform-ready post templates? We’ll tailor Reddit threads, YouTube scripts, LI carousels, and FB variants to your GEO and policy.

Mini “How-to” — launch in 5 steps

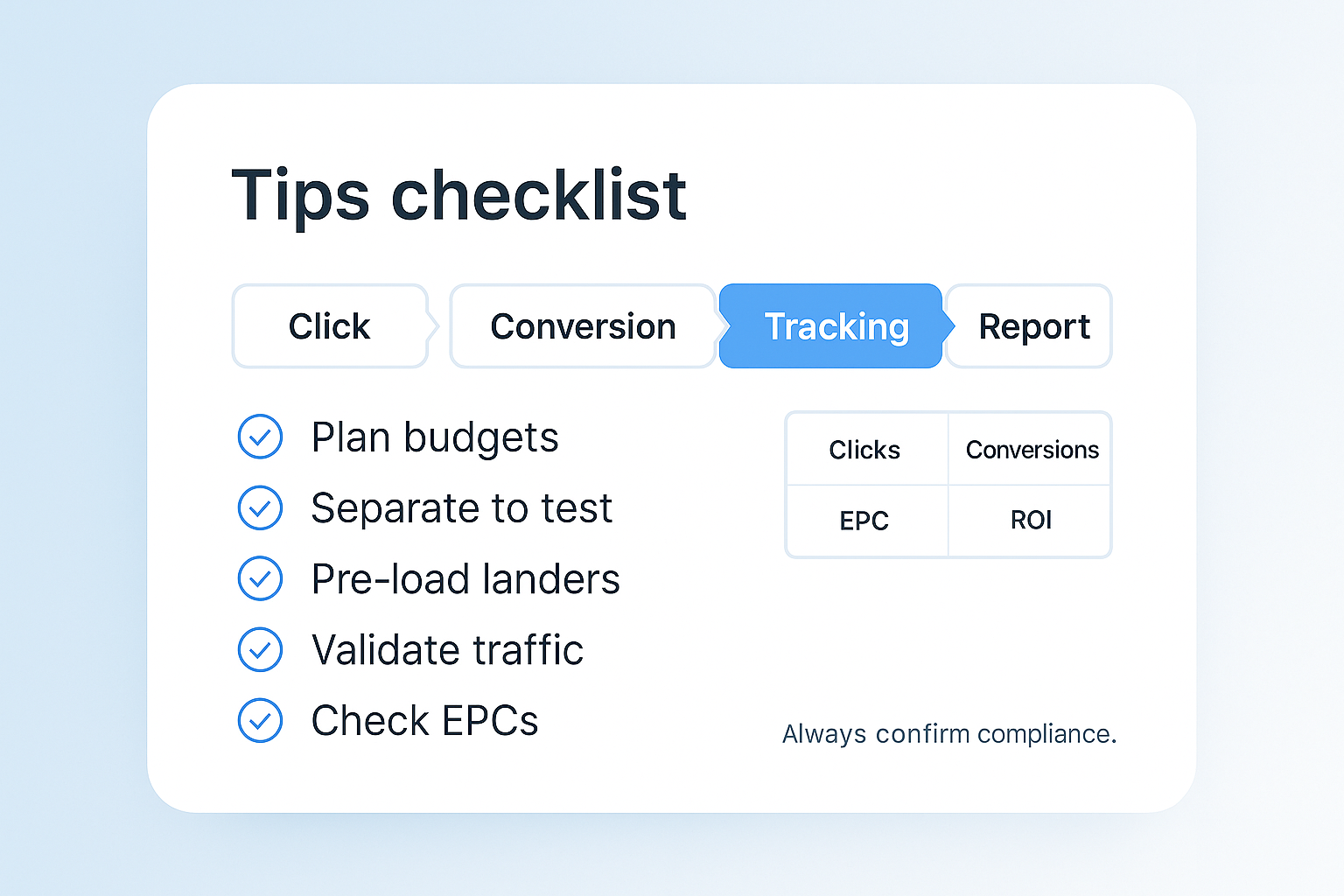

Launching a social campaign for loan CPA offers requires a careful, step-by-step process to ensure compliance, clean tracking, and high Earnings Per Click (EPC). By following this structured approach, you can maximize approvals while maintaining control over cohorts and minimizing risk across platforms like Reddit, YouTube, Facebook, and LinkedIn.

- Get offer-level social permission in writing; save it.

- Draft native posts/videos/carousels + disclosure lines; publish a compliant pre-lander.

- Tag links with UTMs + click ID; enable S2S postbacks; sanity-test end-to-end.

- Launch one platform × one angle × one GEO for 7–14 days; pin EPC + Approval.

- Weekly: log approval/denial reasons; change one lever (copy, UX, routing); retest.

Common mistakes (and quick fixes)

Running social campaigns for loan CPA offers requires careful attention to both compliance and user experience. Even experienced affiliates can stumble on recurring issues that reduce approvals and Earnings Per Click (EPC) if they ignore platform rules, offer restrictions, or messaging best practices.

- Reposting ad copy as organic content → Instead, craft native formats like threads, stories, carousels, or scripts tailored to the platform.

- No disclosure → Always include on-screen, spoken, or text disclosures as required by the social network and offer policies.

- Direct-linking to lenders when disallowed → Always use a pre-lander first if the offer requires it.

- Mixing GEOs/angles in one test → Split cohorts and maintain steady 7–14 day test windows to gather clean, actionable data.

- “Instant/guaranteed” claims → Replace with eligibility-focused phrasing and disclaimers to stay compliant and protect approvals.

A successful social strategy for loan CPA offers depends on compliance, cohort discipline, and content that guides the right users through the funnel. By avoiding common mistakes, using native formats, and tracking approvals carefully, you can optimize EPC and maintain scalable campaigns across Reddit, YouTube, Facebook, and LinkedIn.

Weekly wins = clean cohorts. We’ll help map social permissions to offers. Run compliant social flows — Start on Leadgid.

FAQ

- Ask your AM for the offer’s “Allowed traffic” field and obtain written confirmation (platform scope, required disclosures, pre-lander requirement, brand terms). Archive it.

- Reddit: educational threads/checklists; YouTube: 5–7 min explainers and comparison videos; Facebook: short visual posts with 3 bullets; LinkedIn: carousels, case-study posts, and articles. Always disclose, then route to a pre-lander.

- Eligibility bullets, costs & repayment timelines, a 3-step “how it works,” clear disclosures, and a “Check eligibility” CTA. Keep it fast and mobile-first.

- UTMs for source/medium/campaign/content + a click ID for S2S postbacks. Pin EPC + Approval in a saved cohort view; run tests for 7–14 days.

- Tighten eligibility wording, clarify fees/timelines above the fold, and fix mobile friction. If profiles still mis-fit, route to repair/secured/builder paths.

- Respect subreddit rules, post education-first content, disclose clearly, limit links, and keep a ModMail trail of approvals.