Some loan CPA offers that allow email traffic exist, but permissions are and require permissioned lists, explicit consent logs, and a compliant pre-lander. Set up sender authentication, pass UTMs + a click ID, and measure Delivered → Open → Click → Pre-lander CR → Submit → Approval → EPC by clean cohorts (GEO/device/source/angle).

Key takeaways

- Email is permission-first; never use scraped/bought lists.

- Get Allowed traffic & wording rules in writing; save screenshots/PDFs.

- Always route to a pre-lander (eligibility, fees/timelines, disclosures, “subject to lender approval”).

- Deliverability ≠ optional: SPF/DKIM/DMARC, domain warm-up, list hygiene.

- Track cohorts and approvals weekly; change one lever per 7–14 days.

- Use our loan affiliate template and copy-bank to ship fast.

Can I use email for loan offers? (policy & scope)

When running loan CPA offers that allow email traffic, compliance is not optional — it’s the foundation of sustainable campaign performance. For finance affiliates, the baseline includes using a permissioned list, crafting truthful and clear subject lines and preheaders, providing an identifiable sender name, including a physical mailing address where required, and offering a one-click option to unsubscribe and consent requirements. Most lenders additionally require a pre-lander to educate or pre-qualify users before sending them to the offer, and explicitly prohibit promise language such as “instant” or “guaranteed.” Always confirm at the offer level which channels are allowed (SEO, email, social), what disclosures must be included, and whether brand terms are restricted — get these details in writing and archive them for future reference.

Beyond messaging, you also need to carefully manage consent and data records. Ensure that every recipient’s opt-in is logged with the source, timestamp, IP address, stated purpose, and any suppression events. Opt-outs must be honored immediately, and all consent data should be stored in a way that is auditable in case of disputes or network/lender reviews. Proper management of consent not only protects you legally but also maintains deliverability and trust with both users and partners.

Run permissioned, compliant email flows — Start on Leadgid.

Consent & list quality

High-quality email campaigns start with a well-defined permissioned email list for payday loan offers. For payday loan offers, this means including only contacts who have explicitly opted in, whether through a form checkbox or a double-opt-in process, with all relevant data logged: source, timestamp, and the privacy text shown at signup. Segmenting your list by intent stage — for example, users in the educational stage versus those ready to apply — allows you to send more targeted messaging that maximizes engagement and approvals.

Maintaining list hygiene is equally important. Prune hard bounces, complainers, and unengaged recipients regularly to protect your sender reputation and avoid deliverability issues. For stale contacts, implement re-permission flows to confirm continued interest, or remove them entirely if they fail to respond. A clean, segmented, and fully consented email list ensures that your campaigns reach real, interested users while remaining fully compliant with lender and legal requirements.

Deliverability foundations

Before launching any email campaign, strong deliverability practices are essential to ensure your messages reach the inbox rather than the spam folder. Good deliverability is built on both technical authentication and sender reputation, and it requires ongoing monitoring, careful ramping, and content hygiene to maintain high engagement and low complaint rates.

- SPF/DKIM/DMARC: Publish all authentication records and gradually move DMARC policies from p=none → quarantine → reject as confidence grows in your sending practices.

- Dedicated tracking domain and branded links: Align your From domain with your tracking links to boost credibility and reduce spam flags.

- Gradual volume ramp: Use seedbox testing and keep complaint rates below 0.1% while increasing sending volume.

- Inbox placement monitoring and content linting: Regularly check that emails land in primary inboxes and avoid spam-trigger words, formatting issues, or overly promotional content.

- Sender domain warm-up plan: For warming up a sender domain for affiliates, start with your most engaged 500–1,000 subscribers, sending low-risk educational content. Increase send volume by 25–50% per wave, monitoring opens and complaints at each step to safely establish a positive sending reputation.

Templates — copy you can start from

Below is a loan affiliate email sequence template you can adapt. Keep all claims compliant and route clicks to a pre-lander.

[pic] Email → Pre-lander → Offer funnel (metric chain overlay).

Sequence A — Education → Eligibility → Choice (3 emails)

E1 — Value primer (fees & timelines explained)

Subject: How short-term loans really work (3-minute read)

Preview: Eligibility, fees, and when funds usually arrive.

Body (outline):

- Intro: When a loan fits vs when it doesn’t (no promises).

- Bullets: eligibility (age/residency/income), timing, common fees.

- CTA: Check eligibility → pre-lander (eligibility + disclosures).

E2 — Who qualifies (use-case bullets)

Subject: Do you qualify? 5 quick checks

Body: 5 bullets (employment/income/account/ID/residency), “subject to lender approval”, link to T&Cs.

CTA: See if you’re a match → pre-lander.

E3 — Options (short-term vs installment)

Subject: Short-term vs installment: which fits your month?

Body: 3-step comparison; when to choose each; risks; repayment cadence.

CTA: Compare options → pre-lander with both paths.

Sequence B — GEO-localized variant

Swap currency, pay cycles, service hours, and examples; keep the same blocks and CTAs.

Newsletter format you can reuse

Here are finance CPA newsletter examples that perform well as a modular structure:

- Tip of the week (e.g., how repayment schedules work).

- Eligibility checklist (bullets).

- What to avoid (risky phrases; red-flag claims).

- Single CTA: Check eligibility → pre-lander.

Always keep subject lines truthful and non-sensational; never imply guarantees.

[pic] Template wireframe (subject, preview, body blocks, CTA, footer with unsubscribe).

Pre-lander & landing flow (email-specific)

For email campaigns, the pre-lander and landing flow play a critical role in converting interested users while staying fully compliant. Email traffic demands friction-light pages, fast Largest Contentful Paint (LCP) for speed, and immediate clarity on eligibility, costs, and next steps to maintain trust and maximize approvals.

Email traffic needs friction-light pages, fast LCP, and immediate clarity:

- Above the fold: eligibility bullets; fees & repayment timelines in plain language.

- CTA: “Check eligibility” (not “Get instant approval”).

- Disclosures: “Approval depends on lender assessment”; links to T&Cs, privacy/consent.

- Analytics: pass utm_* + a unique click ID; verify S2S postbacks end-to-end.

- Localize currency, pay cycles, and service hours for each GEO.

Cohorts & metrics

If you’re wondering how to improve email EPC for loan offers, read the funnel in order and fix the tightest bottleneck:

Metric chain: Delivered → Open → Click → Pre-lander CR → Submit → Approval → EPC

- Low Opens → subject/preheader testing; sender reputation; audience match.

[pic] Sender authentication diagram (SPF/DKIM/DMARC + warm-up).

- Low Clicks → CTA clarity; scannable layout; remove competing links.

- Low Pre-lander CR → move eligibility/fees up; compress assets; clearer error states.

- Low Approvals → sharpen eligibility phrasing; verify policy fit; improve mobile UX.

Create clean cohorts (GEO/device/source/angle), hold changes for 7–14 days, and annotate what changed.

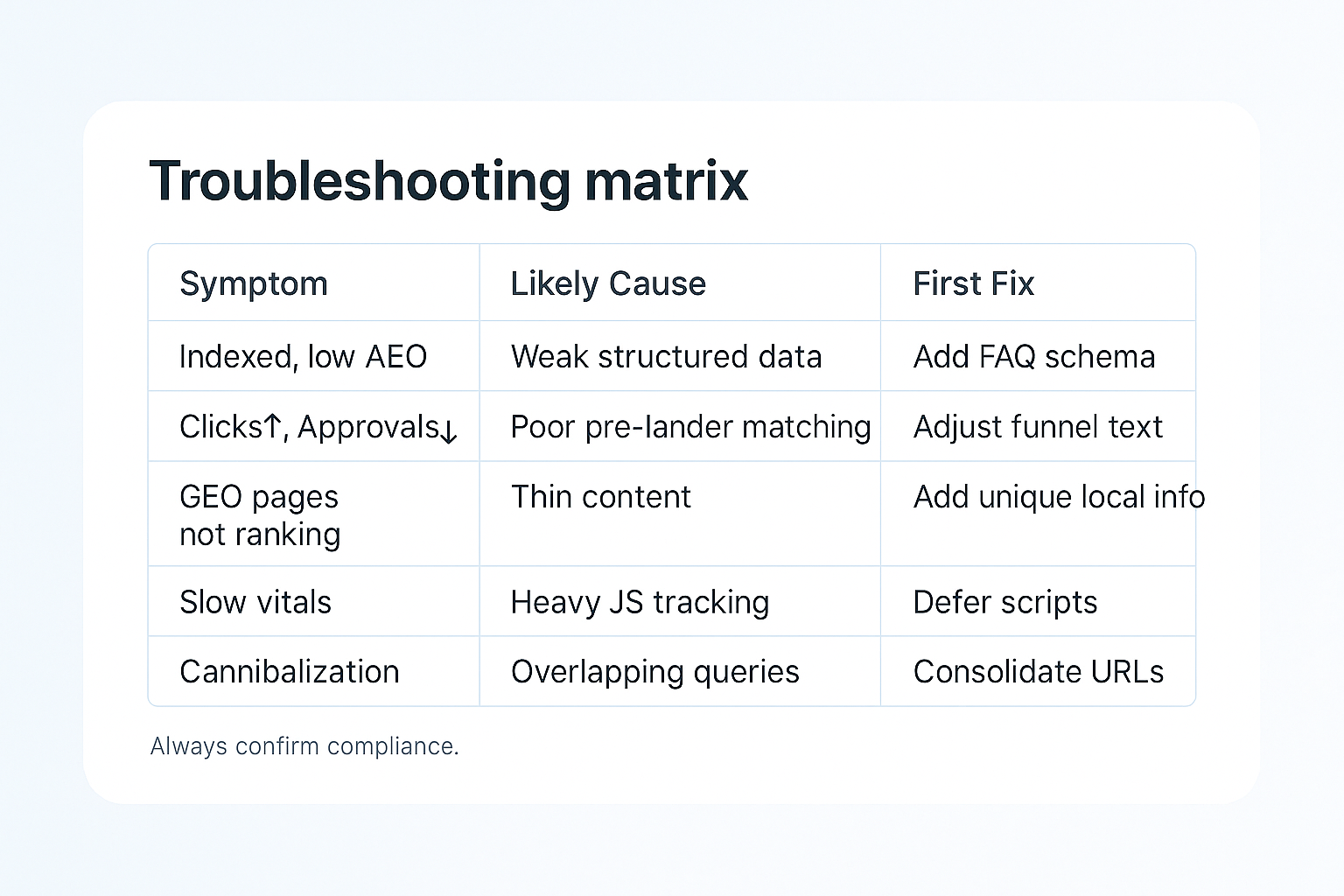

Troubleshooting matrix (symptom → fix)

|

Symptom |

Likely cause |

Quick fix |

|

High spam foldering |

Weak auth or rapid ramp |

Tighten SPF/DKIM/DMARC; slow ramp; prune non-engagers |

|

Opens good, clicks low |

Vague CTA or heavy layout |

One primary CTA; simplify blocks; test button copy |

|

Clicks good, CR low |

Missing eligibility/fees |

Put bullets above the fold; add micro-FAQ |

|

CR good, approvals low |

Policy/fit mismatch |

Re-write eligibility; confirm channel permission; mobile QA |

|

Volatile EPC |

Mixed cohorts or outages |

Split GEO/source; check lender uptime; hold tests steady |

Compliance copy-bank (Do / Don’t)

Crafting compliant messaging is essential for loan and credit email campaigns. Using the right language protects you from denials, maintains trust with users, and ensures adherence to lender and network policies, while avoiding phrases that could trigger compliance issues or regulatory scrutiny.

Do:

- “Check eligibility”

- “Fees may vary by lender and profile”

- “Approval depends on lender assessment”

- “Subject to lender approval”

Don’t:

- “Guaranteed approval” / “Instant approval”

- “Lowest rate guaranteed”

- “No checks ever”

Following a compliant copy-bank ensures your emails remain fully aligned with lender rules and offer requirements, reducing denials and boosting trust. Stick to clear, factual, and eligibility-focused phrasing, and avoid promise-driven language that could lead to non-compliance.

Need help with sender auth & templates? Talk to a manager.

Mini “How-to” — Launch in 5 Steps

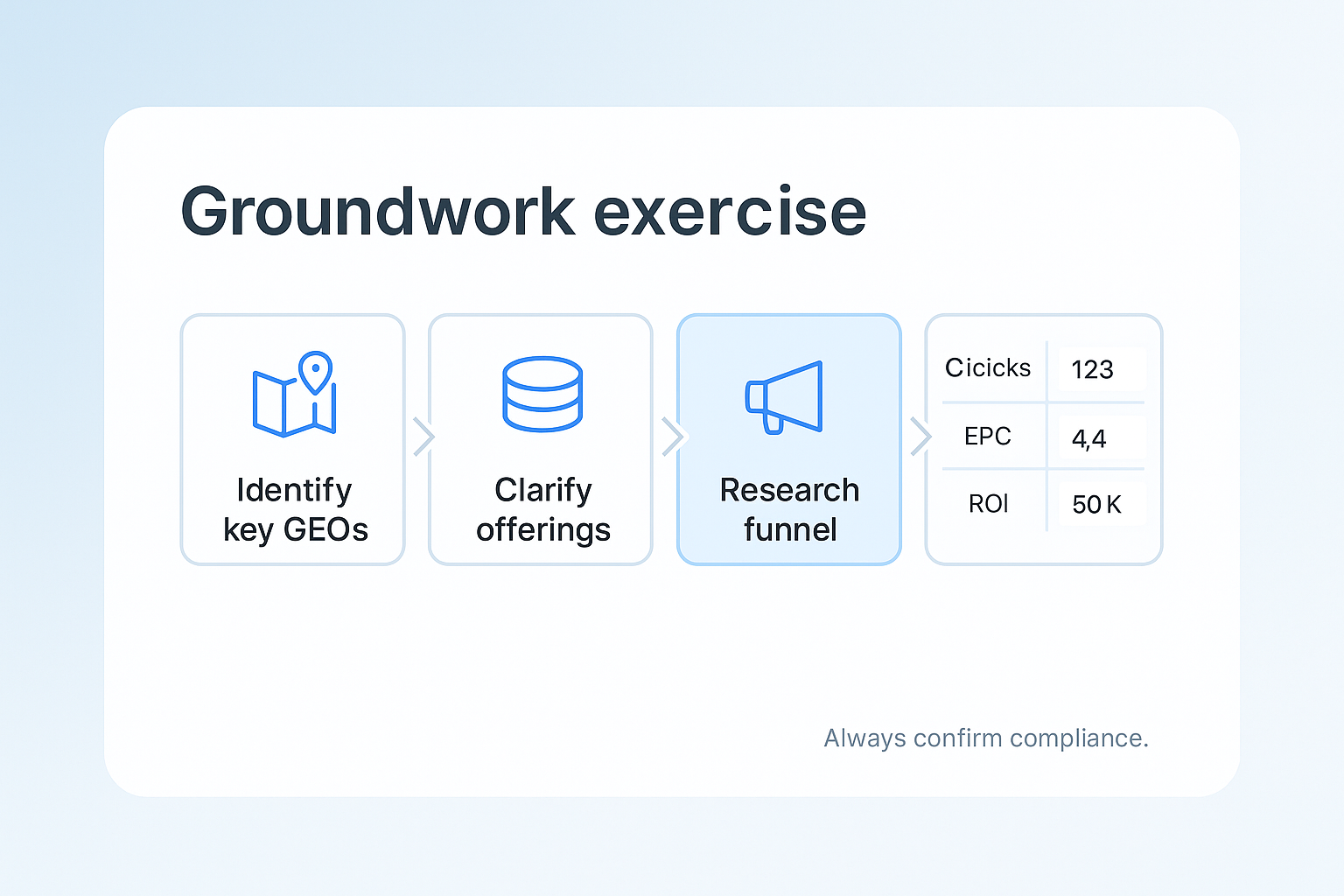

Launching an email campaign for loan or credit offers is most effective when you follow a structured, step-by-step approach. These five steps guide you from compliance verification to cohort testing, ensuring clean tracking, high deliverability, and reliable Earnings Per Click (EPC) and approval data for ongoing optimization.

- Confirm allowed traffic and wording in writing; save proof for future reference.

- Configure SPF/DKIM/DMARC and gradually ramp a warmed sender using your most engaged segments.

- Import only permissioned contacts; map UTMs + click ID and publish a fully compliant pre-lander.

- Send Sequence A to one clean cohort for 7–14 days and verify postbacks end-to-end.

- Weekly: log approvals/denials, update eligibility/fees copy or UX, and iterate one lever at a time to maintain clean testing and measurable results.

Common mistakes (and quick fixes)

Email campaigns for loan and credit offers are highly sensitive to compliance, deliverability, and user trust. Even small missteps can dramatically reduce approvals and Earnings Per Click (EPC), so knowing the most frequent mistakes and how to correct them is key to stable, high-performing campaigns.

- Buying lists. → Stop immediately; rebuild using contacts with explicit consent or run re-permission flows.

- Skipping authentication. → Inboxing will suffer; ensure SPF/DKIM/DMARC records are in place before scaling.

- Promise language. → Replace with compliant eligibility phrasing and include all required disclosures.

- No pre-lander. → Denials spike; include eligibility, fees, and timelines above the fold.

- Mixing changes. → Test one cohort, one change, one 7–14 day window to isolate results and maintain clean reporting.

Success with email campaigns relies on permissioned lists, proper authentication, compliant messaging, and structured pre-landers. Maintaining clean cohorts and testing one variable at a time ensures predictable performance, higher approvals, and better EPC.

Run permissioned, compliant email flows — Start on Leadgid.

FAQ

- Ask your AM for offers that list email as permitted in “Allowed traffic,” then get written confirmation of conditions (pre-lander, disclosures, restricted wording).

- Permissioned list, clear sender identity, physical address where required, one-click unsubscribe, truthful subject/preheader, and policy-compliant copy.

- Yes—adapt the blocks and route to a compliant pre-lander. Keep claims conservative and match each offer’s rules.

- One useful tip, an eligibility checklist, a compliance reminder, and a single CTA. Avoid multiple competing links.

- Authenticate, start small with engaged users, increase gradually, and watch reputation/complaints before scaling.

- Source, timestamp, IP, the exact consent text shown, and all unsubscribe/suppression events.