Choosing the best CPA networks for credit card offers depends on five things: GEO & issuer density, offer-level allowed traffic, payout cadence, reporting/API, and manager support. Shortlist a few partners, run one clean cohort test per network for 7–14 days, and keep the one that delivers the most stable approvals/issuances with compliant flows.

Key takeaways

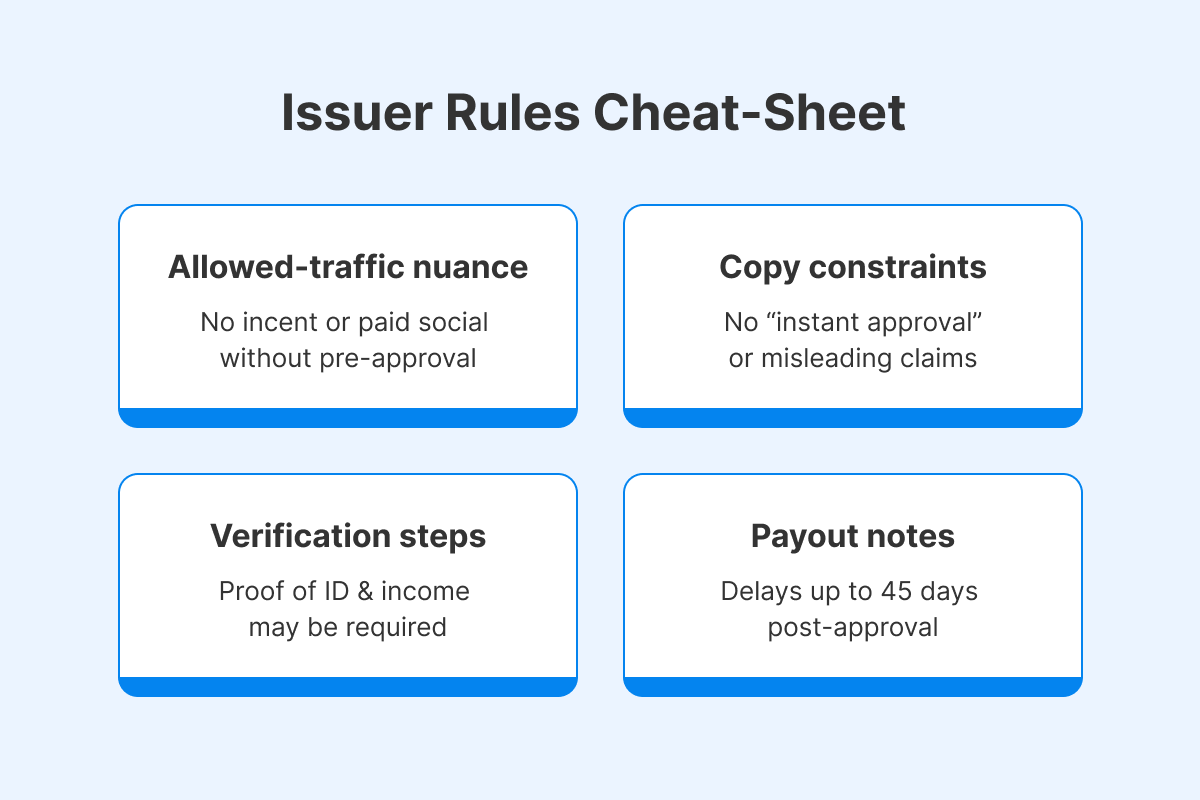

- Issuer density + policy fit beat brand name. Cards are stricter than loans; expect vetting and firmer copy rules.

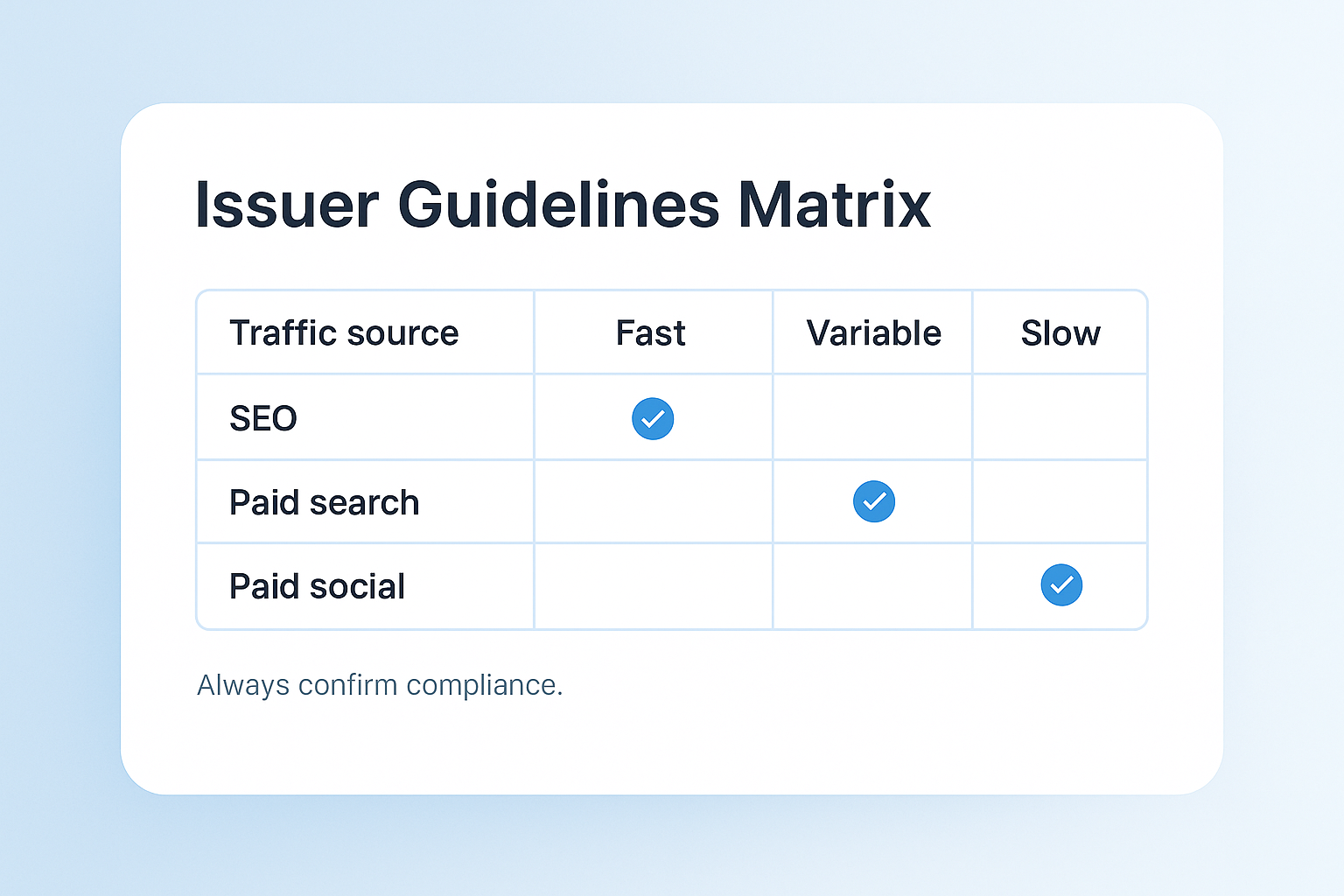

- Match your real channel (SEO/email/social) to offer-level permissions; keep written confirmation.

- Chase consistency, not spikes: approvals/issuances drive EPC more than clicks.

- Prefer weekly/fast payouts (where eligible) and networks with postbacks, API & cohort views.

- If prime cards under-approve, route to secured cards or credit repair as step-ups.

- Always use a pre-lander: eligibility, fees/timelines, disclosures (“subject to issuer approval”).

Best CPA Networks for Credit Card Offers

When searching for reliable affiliate platforms, knowing which ones deliver consistent results is essential — especially if your focus is on credit card campaigns. In this guide, we explore the best CPA networks for credit offers, defining “best” as the networks most likely to produce steady approvals and strong Earnings Per Click (EPC) — calculated as total revenue divided by total clicks — for your specific traffic. By applying consistent evaluation criteria, you can quickly identify networks that align with your GEO, traffic type, and product vertical, reducing wasted spend and troubleshooting.

How We Evaluate “Best” for Cards

To ensure a fair comparison across networks, we use the same yardstick for every candidate:

- GEO coverage & issuer density. Check that your target countries have enough issuing banks or lenders to maintain approval flow.

- Product mix. Consider which types of cards are offered: unsecured/secured, credit-builder, BNPL, or credit repair programs.

- Allowed traffic (offer-level). Confirm SEO/email/social permissions, brand term restrictions, and pre-lander requirements to avoid policy violations.

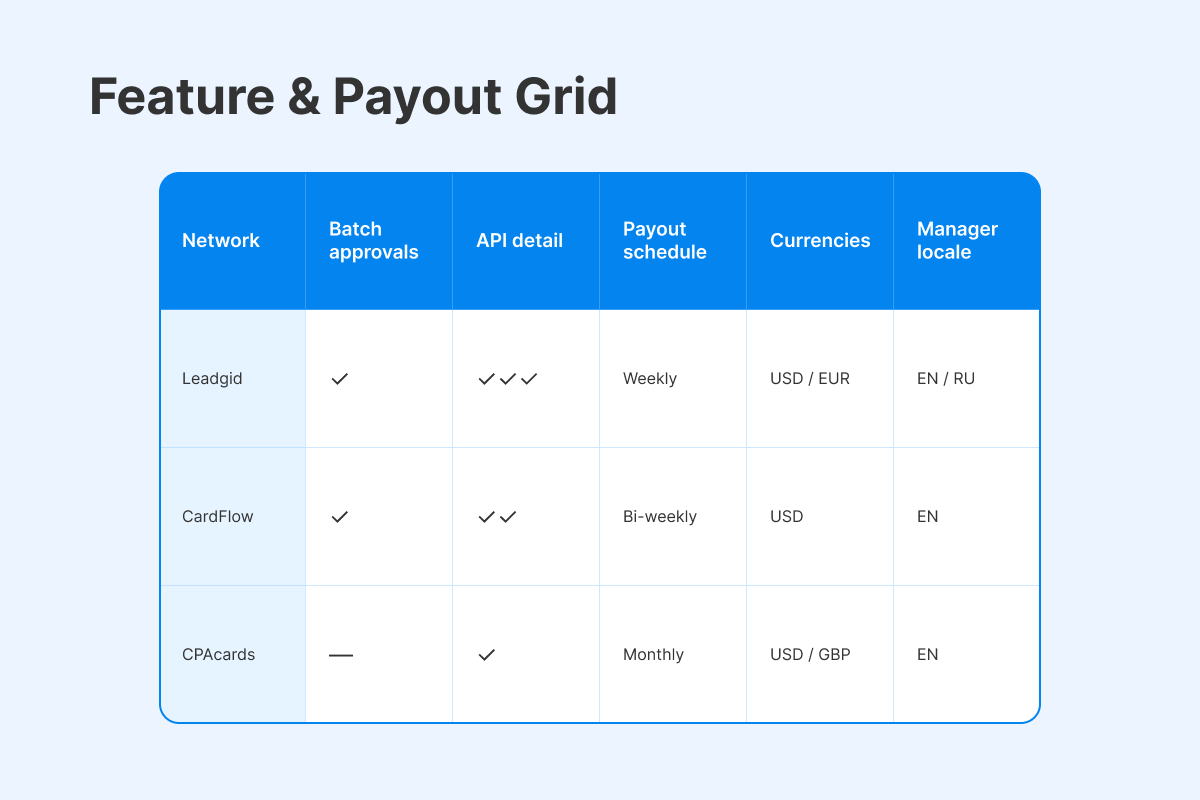

- Payout cadence & currencies. Review whether payouts are weekly or NET, and which currencies (EUR/USD/local) are supported.

- Reporting/API & postbacks. Ensure clean cohort tracking, server-to-server (S2S) postbacks, and easy reconciliation.

- Manager support & localization. Fast, practical guidance in the right language helps resolve issues and optimize campaigns efficiently.

- Onboarding/KYC speed. How quickly can you start testing offers without unnecessary delays?

Ultimately, approvals and EPC are driven by a combination of policy fit, pre-qualification, and mobile UX. Address any bottlenecks in these areas first, and scaling becomes predictable and more profitable.

Compare high-approval card programs — Start on Leadgid.

Shortlist — Who’s on the Radar

When evaluating the best CPA networks for credit card offers, know which platforms combine strong lender access, multi-region coverage, and approval-focused workflows. The networks below are consistently on our radar for affiliates seeking stable Earnings Per Click (EPC). They also have reliable approvals, and flexible campaign options across multiple loan and credit card products. Each network has distinct strengths, matching them to your GEO, traffic type, and product vertical. It is key to running successful campaigns without compliance issues or wasted clicks.

- Leadgid. Multi-GEO finance coverage with approval-focused workflows and hands-on account managers (AMs). Ideal when you need guidance balancing secured and unsecured credit cards, credit-builder cards, and adjacent personal-credit flows across ES/MX/PH/IN/KZ and other regions. Their cohort-friendly reporting and manager support make them especially useful for affiliates testing multiple angles without mixing variables.

- financeAds (EU). A Europe-centric marketplace featuring bank and fintech programs. Use when operating in ES/DE/PL and needing a mix of issuer-level variety along with dedicated local AM support. The platform is strong for affiliates who want structured, compliant campaigns with a range of credit card products and localized oversight.

- Admitad / Awin (Aggregators). Broad multi-GEO access to finance and card programs. Use when sourcing localized credit card offers across multiple regions, especially if you need access to a wide variety of issuers and traffic types. Their aggregator model simplifies testing across countries without building separate partnerships for each bank or lender.

- Round Sky (US). US specialists in personal and short-term credit with deep access to card-adjacent flows. Use when running US cohorts and requiring decision depth in related finance verticals. The platform is particularly helpful for affiliates who want fast lender decisioning and reliable approvals for adjacent product testing.

- LeadsMarket (US). US marketplace model with strong lender aggregation. Ideal when you need marketplace routing and dense US-centric demand. Allows smooth scaling across multiple offers while maintaining clean cohort data and reliable EPC tracking.

- Involve Asia (SEA). Southeast Asia aggregator with app-driven finance programs. Best for campaigns targeting PH/ID/MY/TH, where app-based flows dominate and localization — including language and UX — significantly impacts approvals. Their platform supports structured testing across social and mobile traffic while respecting offer-level restrictions.

- vCommission (IN-first). India-focused network with strong regional reach. Use when building IN cohorts and needing access to local credit cards, repair products, or personal finance offers. Their localized support ensures compliance and guidance for high-intent traffic in India.

- CityAds (KZ/CIS). Regional coverage with RU/KZ language support and finance verticals. Ideal when operating in KZ/CIS, needing local lender access and hands-on assistance for compliant pre-landers and cohort tracking.

One-line check: If you’re asking which affiliate networks offer credit card signups, several do, but permissions, traffic restrictions, and copy rules are highly offer-specific. Always confirm these in writing with the network before launching campaigns to avoid denials or compliance issues.

Comparison — Credit/Cards partner landscape

Policies vary by offer. Confirm SEO/email/social & brand bidding in writing; many card programs require pre-approval and stricter copy. Build a pre-lander with eligibility, fees/timelines, and issuer disclosures.

|

Network |

GEO coverage (examples) |

Product types (cards/credit/repair) |

Allowed traffic* |

Payout cadence |

Currencies |

Reporting / API |

Manager support |

Use when |

|

Leadgid |

ES, MX, PH, IN, KZ + |

Cards (secured/unsecured), credit-builder, personal, repair |

Per-offer |

Weekly / NET (per offer) |

Multi |

Dashboard, postbacks, API |

Local/regional AMs |

Multi-GEO testing, approval-focused iterations |

|

financeAds (EU) |

ES, DE, PL, etc. |

Cards, bank/fintech, repair (by program) |

Per-offer |

Per program |

EUR + local |

Network reporting |

Local AMs |

EU issuers & fintech mix |

|

Admitad / Awin |

Multi-GEO |

Cards/credit, repair (varies) |

Per-offer |

Per program |

Multi |

Tools/API (varies) |

AM support |

Sourcing localized programs |

|

Round Sky (US) |

US |

Personal/adjacent credit flows |

Per-offer |

Per program |

USD |

Real-time reporting |

AM support |

US decisions depth / adjacencies |

|

LeadsMarket (US) |

US |

Personal/adjacent |

Per-offer |

Per program |

USD |

Marketplace dashboard |

AM support |

Marketplace routing in US |

|

Involve Asia (SEA) |

PH, ID, MY, TH, SG |

Cards/credit apps (by program) |

Per-offer |

Per program |

Local/APAC |

Dashboard |

Regional AMs |

SEA app-driven cohorts |

|

vCommission |

IN (+ SG/UAE/UK/US) |

Cards/credit, repair (varies) |

Per-offer |

NET terms |

INR + |

Reporting |

AM support |

India-first + regional |

|

CityAds |

KZ/CIS + |

Cards/credit (regional) |

Per-offer |

Per program |

KZT/RUB + |

Network tools |

AM support |

KZ/CIS language & support |

* Always check the specific offer for channel rules, brand terms, and pre-lander requirements.

Need help with issuer policies? Talk to a manager.

Leadgid vs Others — choose by scenario

Choosing the right CPA network isn’t just about brand recognition — it’s about matching your traffic, GEO, and product vertical to the network’s strengths. Different networks excel in different regions and credit-product types. So knowing when to use Leadgid versus regional aggregators or specialized marketplaces can save time and reduce denials. It also helps maximize Earnings Per Click (EPC) across your campaigns.

- Leadgid when you need multi-GEO coverage and an approval-first game plan across cards, credit-builder, and personal-credit adjacencies—all with manager feedback on denial reasons and localization.

- EU aggregators (e.g., financeAds) when issuer density and bank/fintech variety in ES/DE/PL are your priority.

- US specialists/marketplaces (Round Sky, LeadsMarket) when your cohorts are US-only and you want decision depth in adjacent personal-credit flows.

- SEA/IN platforms (Involve Asia, vCommission) when cohorts are PH/ID/MY/TH/IN and app-driven patterns + local AMs matter.

- If prime cards under-approve, pivot to the best affiliate programs for secured credit cards or to credit repair affiliate cpa programs as compliant step-ups.

[pic] Cards comparison diagram (Leadgid vs categories of alternatives with “use-when”).

Compliance & channel notes (cards/credit)

Success with credit card affiliate campaigns depends as much on compliance as on traffic quality. Understanding which channels are allowed and how to structure your messaging ensures approvals stay high, reduces denials, and protects both you and the network from policy violations.

- Credit card affiliate programs that allow SEO — they exist, but typically require strict content standards, proper disclosures, and no brand bidding unless explicitly approved. Keep titles and snippets free of promise language to avoid misleading users.

- Instant approval credit CPA offers — treat this as a user query only; messaging such as “instant” or “guaranteed” is generally non-compliant. Use phrases like “check eligibility; decisions are subject to issuer approval.”

- Always run an intent page → pre-lander → issuer flow. The pre-lander must clearly show eligibility, fees, timelines, terms & conditions, privacy/consent, and “subject to issuer approval” to maintain compliance and maximize approvals.

[pic] Compliance icons (no guarantees, issuer approval, disclosures).

Benchmarks & setup (what to expect)

Before scaling any credit card or personal-credit campaign, it’s essential to establish a clear baseline and structured setup. Since Earnings Per Click (EPC) depends more on approvals and issuance than sheer clicks, setting benchmarks, cleaning cohorts, and monitoring postbacks ensures you can quickly spot issues, optimize effectively, and maintain steady campaign performance.

- EPC hinges on approval/issuance more than clicks. Establish a week-1 baseline; trend up by clarifying eligibility and fixing mobile friction.

- Keep cohorts clean: GEO / device / source / angle; hold tests for 7–14 days.

- Enable postbacks + UTMs; pin EPC + Approval (+ Issuance if available).

- If EPC dips, check approvals first, then issuer mix, device performance, and policy drift.

Mini “How-to” — first 5 steps

Getting started with credit card and personal-credit campaigns is easiest when you follow a structured, repeatable approach. These first five steps guide you from network selection to cohort launch, ensuring compliance, clean tracking, and reliable Earnings Per Click (EPC) and approval data for ongoing optimization and scaling.

- Shortlist two networks with card/credit coverage in your GEO.

- Confirm offer-level permissions (SEO/email/social, brand terms) and requested disclosures in writing.

- Build a compliant pre-lander (eligibility, fees/timelines, issuer disclaimer).

- Launch one clean cohort per network; pin EPC + Approval; reconcile with payouts.

- If approvals stay tight: test secured cards → then credit repair routing.

[pic] Cohort flow for cards (choose network → allowed traffic → pre-lander → approvals/EPC).

Common mistakes (and quick fixes)

Even experienced affiliates can fall into patterns that quietly undermine approvals and Earnings Per Click (EPC). Knowing the most frequent pitfalls and how to fix them quickly helps maintain clean cohorts, compliant messaging, and steady campaign performance, saving both time and wasted traffic.

- Picking by brand, not GEO/issuer density → Filter by actual coverage, AM speed, and policies.

- Brand bidding without approval → Remove; use generic/intent terms.

- Skipping pre-landers/disclosures → Denials/complaints rise; add eligibility + fees/timelines.

- Mixing GEOs/sources/angles → Split cohorts; 7–14 day windows.

- Using promise language (“instant/guaranteed”) → Replace with eligibility phrasing.

Successful credit card and personal-credit campaigns are built on disciplined cohort management, compliance, and approval-focused optimization. From selecting the right networks and confirming offer-level permissions, to building compliant pre-landers and tracking EPC and approvals, each step ensures predictable performance and reduces troubleshooting.

Ready to test? We’ll verify allowed traffic, review your pre-lander, and pin the right cohort report. Join Leadgid today!

FAQ

- The best partner is the one that fits your GEO issuer density, offer-level allowed traffic, payout cadence, reporting/API, and manager support. Use the comparison table and run one clean cohort per candidate.

- Check offer-level permissions, brand term rules, disclosure requirements, and whether publisher vetting is needed. Get approvals in writing.

- Match GEO and issuer rules, use a compliant pre-lander with eligibility and disclosures, and keep cohorts clean with postbacks and weekly approval feedback.

- When prime/unsecured cards under-approve or the profile needs improvement. It’s a compliant step-up path before re-attempting cards.

- Yes: stricter content standards, clear disclosures, and typically no brand bidding. Titles/snippets must avoid promise language.

- Avoid “instant/guaranteed” claims; approvals are subject to issuer assessment. Use “check eligibility” phrasing and required disclosures.